The government’s Mortgage Guarantee Scheme has been brought forward and launches next Monday, 7th October (three months earlier than the scheduled date of 1st January next year).

From October 2013, Help to Buy has been extended to make it possible to purchase any property under £600,000 – be it a new build or pre-owned home – with as little as a 5% deposit.

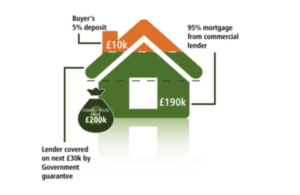

How does the Mortgage Guarantee scheme work?

The process of applying and repaying the mortgage is the same as it would be for a standard mortgage – there really is very little difference for the buyer. The scheme is intended to increase the availability of mortgages at competitive interest rates for buyers with a minimum of 5% deposit. The government are going to make this possible by guaranteeing repayment of the mortgage to the lender, this will be dealt with behind the scenes by participating lenders. There will be no additional paperwork or charges for the buyer.

Below is a quick checklist of who is eligible for the scheme:

- Available to both existing home owners and first-time buyers

- Buyers need a minimum of a 5% deposit

- Available on all previously owned and new build properties up to the value of £600,000

- Must be your only property

- Available to British citizens for properties in England only

- Borrowing from a participating mortgage lender

https://www.gov.uk/government/news/help-to-buy-mortgage-guarantee-available-3-months-early