Help to Buy Equity Loan

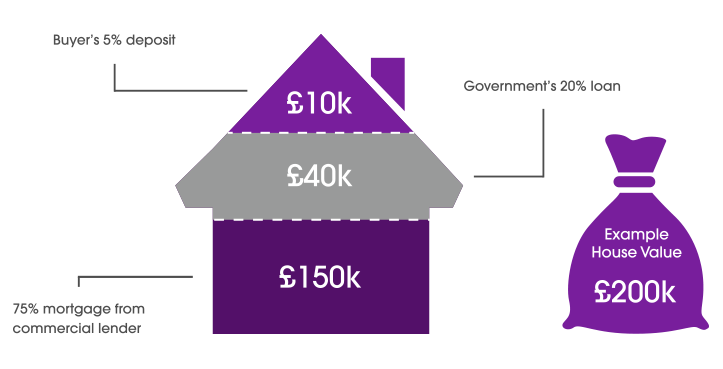

With the Help to Buy equity loan, the Government may loan you up to 20% of the value of your newly built home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the balance.

Equity loan conditions:

- You need to have a minimum of 5% deposit to be eligible for the scheme

- You are not allowed to sublet or use part-exchange on old home

- You must not own any other property at the time you buy your new build home

- The maximum property value is up to £600,000

- Open to both first-time buyers and existing homeowners

Equity loan example:

Help to Buy Remortgage

Is your Help to Buy mortgage product coming to an end? There are ‘Help to Buy remortgage’ deals up to 75% loan to value on the market or if you would prefer to pay back your Help to Buy Government Loan and then remortgage, there are products available up to 90% loan to value.

These mortgage products are available over 2, 3 and 5 years.

Help to Buy ISA

This account allows the ISA holder to earn up to 2.5% interest tax-free and then the government will top-up the account with 25% tax-free cash, however this account is no longer available to new customers.

More information:

HelpToBuy.gov.uk – how does it work?

Help to Buy ISA Guide from HMRC

Lifetime ISA (LISA)

You can use a Lifetime ISA (Individual Savings Account) to buy your first home or to save for later life. You must be 18 or over but under 40 to open a Lifetime ISA (but you can continue to pay in until your 50th birthday). You can put in up to £4,000 each year and the government will add a 25% bonus to your savings, up to a maximum of £1,000 per year. The Lifetime ISA limit of £4,000 counts towards your annual ISA limit which is £20,000 for the 2018-19 tax year.

To open and continue to pay into a Lifetime ISA you must be a resident in the UK, unless you’re a crown servant (for example, in the diplomatic service), their spouse or civil partner.

You can withdraw money from your ISA if you are:

- Buying your first home

- Aged 60 or over

- Terminally ill, with less than 12 months to live

You’ll pay a 25% charge if you withdraw cash or assets for any other reason.

Contact us to discuss your Help to Buy options